Annual U.S. clean energy investment grows 37%

Best Renewable Energy Company in Nigeria > Article > Annual U.S. clean energy investment grows 37%

- by

- Article

Annual U.S. clean energy investment grows 37%

Investment grew year-over-year as it reached $213 billion, including $39 billion of investment clean energy manufacturing, according to a report from MIT and Rhodium Group.

A report from Rhodium Group and the Massachusetts Institute of Technology (MIT) showed that the United States’ commitment to a clean energy transition is continuing to rise precipitously, with total investment in clean energy, clean transportation, building electrification and carbon management reaching $213 billion over the last year (from July 1, 2022 to June 30, 2023).

The $213 billion invested represents a 37% leap over 2021/2022 investments of $155 billion. Clean investment continues to strongly increase each year. In 2018/2019, total investments reached $81 billion, and it has climbed each year since.

Domestic manufacturing of clean energy technologies has become an increased focus in recent years, and rich tax credits and incentives have served as an attracting force. Manufacturing investments totaled $39 billion in 2022/2023, more than doubling the $17 billion invested in the previous report period.

Over the past two years, combined investment announcements in clean energy and electric vehicle manufacturing totaled $137 billion, a fivefold increase over the previous two years. Rhodium Group estimates that $37 billion of the total announcements over the past two years has already been invested. Over the last three quarters, batteries and zero-emission vehicles have represented the largest segment of actual manufacturing investments, followed by solar manufacturing announcements.

“Investment in clean energy production and manufacturing is surging. New jobs and revenue are bringing opportunity and optimism to rural communities across the country. America’s manufacturing centers are competing to meet new clean energy demand with a new domestic wind, solar or storage manufacturing facility announced every four days,” said Jason Grumet, chief executive officer of American Clean Power (ACP).

Should currently announced manufacturing facilities reach operation, ACP estimates a nearly ninefold increase in solar module production and a more than fifteenfold increase in grid-scale battery storage, along with significant increases in production output for solar cells, polysilicon, ingots and wafers, as well as wind components. The report indicates that if the anticipated manufacturing facilities reach operation, U.S. solar module production could grow to 62 GW.

As for energy production and industrial investments in clean technologies, the report said over $257 billion in new investments have been announced over the last two years. This represents a 75% increase over the previous two years for investment in clean energy production, carbon dioxide capture or removal, and other forms of industrial decarbonization.

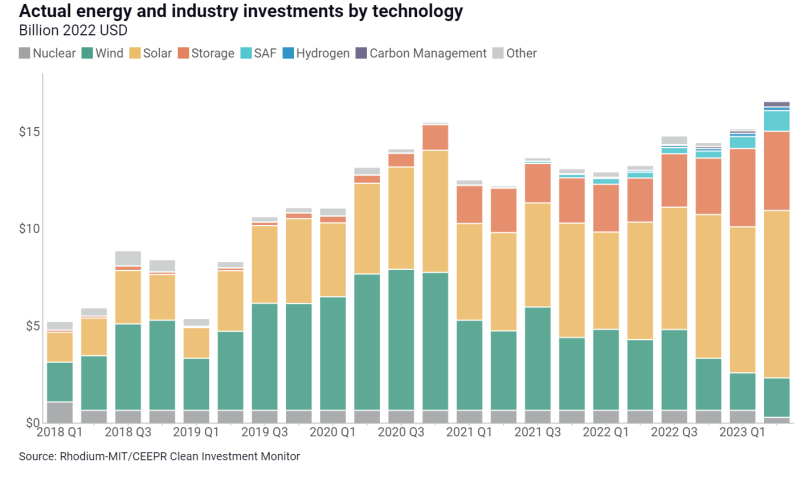

Image: Rhodium Group / MIT

“The majority of these announcements have focused on the complementary technologies of solar PV and grid-connected storage, while announced investment in new wind projects declined by half over the same period,” said the report.

Only $63 billion of the $257 billion in announcements has occurred, which the report attributes to relatively long project lead times for large energy generation projects. Solar represented the largest energy and industry investment category in Q2 2023, attracting $8.62 billion. This was followed by storage with $4.08 billion, and wind with $2.03 billion.

Retail investment in clean energy is on the rise as well. American businesses and households invested $113 billion last year in zero emission vehicles, heat pumps and distributed energy like rooftop solar and energy storage. The fastest growth for this category was in zero-emissions vehicles (ZEV), which climbed 46% and reached $70 billion in retail investment.

“Purchase and installations of residential and commercial rooftop solar systems, other distributed renewables, fuel cells and battery storage has increased robustly as well, while heat pump installations slowed last year after four years of meaningful growth,” said the report.

Rhodium Group and MIT’s database of clean energy transition investments can be explored here.