Private investments in clean energy and manufacturing top $270 billion

Best Renewable Energy Company in Nigeria > Article > Private investments in clean energy and manufacturing top $270 billion

- by

- Article

Private investments in clean energy and manufacturing top $270 billion

While the U.S. has the financial capacity, technology and human capital, the question is whether government policy will allow for the clean energy infrastructure to be built out fast enough to achieve clean energy dominance.

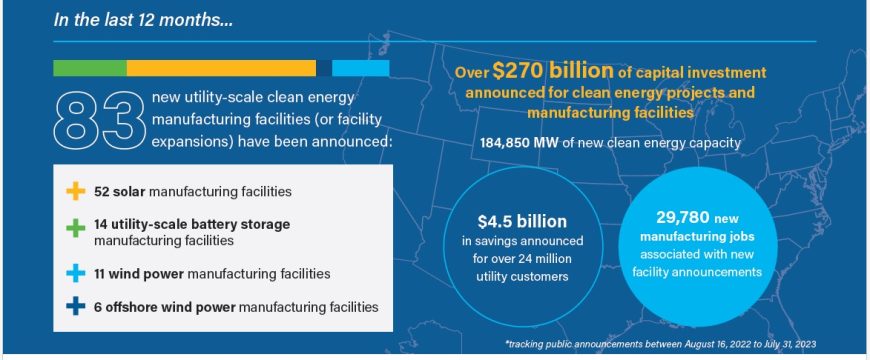

The Inflation Reduction Act, passed nearly one year ago, has stimulated an unprecedented level of clean energy investments in the United States. A report from the American Clean Power Association (ACP) shows federal support has led to announced private investments totaling $271 billion in domestic clean energy projects and manufacturing facilities over the past 12 months. This exceeds the combined clean energy investments made over the previous eight years.

The Clean Energy Investing in America report estimates that announced projects total 184.85 GW of new utility-scale clean energy capacity. To bring domestic content to these projects, 83 new or expanded utility-scale clean energy manufacturing facilities have been announced, amounting to an investment of over $22 billion, and opening nearly 30,000 new manufacturing jobs.

“Investment in clean energy production and manufacturing is surging. New jobs and revenue are bringing opportunity and optimism to rural communities across the country. America’s manufacturing centers are competing to meet new clean energy demand with a new domestic wind, solar or storage manufacturing facility announced every four days,” said Jason Grumet, CEO of ACP.

Grumet noted that while the U.S. has the financial capacity, technology and “human capital,” the question is whether government policy will allow for the clean energy infrastructure to be built out fast enough to achieve clean energy dominance.

The report also showed a significant uptick in the manufacturing capacity of clean power components, thanks to the 83 announced facilities. The report says that 52 of these facilities are supporting the utility-scale solar industry and 14 support utility-scale battery storage.

Should currently announced manufacturing facilities reach operation, ACP estimates a nearly ninefold increase in solar module production and a more than fifteenfold increase in grid-scale battery storage, along with significant increases in production output for solar cells, polysilicon, ingots and wafers, as well as wind components. The report indicates that if the anticipated manufacturing facilities reach operation, U.S. solar module production could grow to 62 GW. Production of cells, ingots and wafer are also expected to increase.

In addition to boosting U.S. clean energy, the new buildout is revitalizing American manufacturing, which has been in decline. Grumet points out that steel mills are being repurposed to manufacture clean energy components. For example, a former steel mill will be rebuilt to produce wind foundation components, investing an estimated $115 million in the community and creating nearly 300 local jobs.

Manufacturing facilities for utility-scale clean energy components have been announced in districts across the country, and multiple states have announced five or more facilities, including Georgia (7), Tennessee (6), South Carolina (6), Texas (5), and Colorado (5).

One particular manufacturing facility is being built by German company, Meyer Burger, which is redirecting the manufacturing equipment originally intended for a German facility. Instead it will be used to set up a 2 GW solar cell manufacturing facility in Colorado Springs, Colo. to supply its previously announced solar module plant in Goodyear, Ariz. Production of the solar cells is expected to start in Q4 2024.

The report includes an interactive map that shows where manufacturing facilities are planned.

Challenges

An industry planning to build clean energy production and manufacturing facilities faster than ever before will face some hurdles, the report contends. These challenges include supply chain issues, inflation, permitting bottlenecks and opposition. ACP says the opposition is driven by misinformation and must be addressed—along with the other challenges– in order to reach the full potential of the incentives provided by the IRA.

Permitting for clean energy facilities can take from five to ten years, ACP reports, stating that Congress needs to pass permitting reforms in order to take full advantage of the investments and move clean energy forward. The report also suggests that Congress find common ground on transmission policy to ensure that cheap, abundant clean energy can find its way to consumers.

An important benefit to the American people is the consumer savings, estimated by ACP to be $4.5 billion. The report cites estimates from several U.S. utilities that report reduced electricity costs as a result of federal incentives. Duke Energy Florida, for example, reports that it plans to decrease rates, saving customers $56 million annually. Pointing to the production tax credits within the IRA, Duke Energy Florida state president, Melissa Seixas said that Duke Energy sees this as a way of passing tax savings on to its customers.

The American Clean Power Association (ACP) represents 750 utility-scale solar, wind, energy storage, green hydrogen and transmission companies.