Peak Energy moves toward establishing a domestic market for sodium-ion energy storage systems

Best Renewable Energy Company in Nigeria > Article > Peak Energy moves toward establishing a domestic market for sodium-ion energy storage systems

- by

- Article

Peak Energy moves toward establishing a domestic market for sodium-ion energy storage systems

Sodium-ion energy storage system manufacturer, Peak Energy, is working to streamline what it believes is the biggest bottleneck to scaling enough battery energy storage systems to accommodate 80% renewable energy generation and 100% carbon-free electricity by 2035.

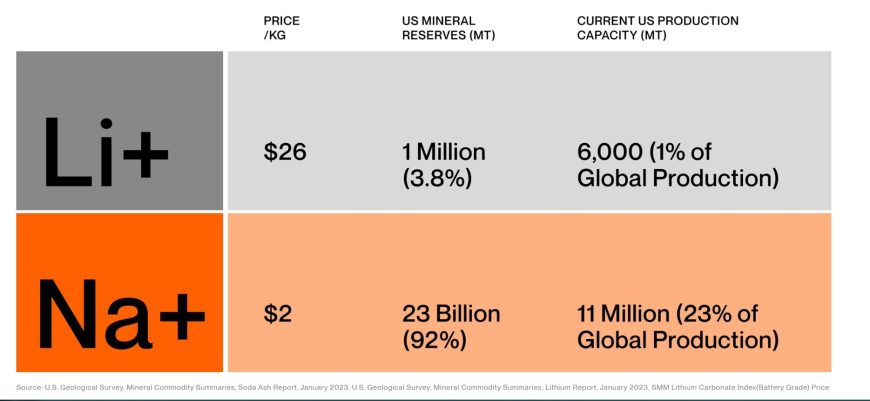

Peak Energy has set out to use cheaper and more abundant raw materials to design sodium-ion battery energy storage systems (BESS). While a sodium-ion BESS is 30% less energy dense than those made from lithium-ion chemistries, they are also about 20% to 40% cheaper, says Landon Mossburg, who co-owns Peak Energy with Cameron Dales. Moreover, the U.S. has 19% of the world’s soda ash, from which sodium is derived. According to the Environmental Protection Agency, six companies in Wyoming and California comprise the U.S. soda ash industry. which is the largest in the world.

Peak Energy sees the ability to scale as another bottleneck. To overcome this challenge, the company is leveraging partnerships with international and domestic sodium cell manufacturers to introduce this technology to the U.S., while generating enough income to establish a local engineering site and gigafactory.

“We’ll do this in three phases,” Mossburg said.

Currently ongoing, Phase I involves importing the sodium-ion battery cells from manufacturers based in Asia, Europe and North America while producing packs in the U.S. The company plans to launch small-scale demonstration systems early next year with an expected energy capacity and duration of 3MW/h.

“When stacked together, they can create a larger scale utility system,” Mossburg said. The company will scale these systems to several 100MW/h commercial projects throughout 2026.

Peak Energy is currently testing cells from potential partners to decipher the best technology for U.S. markets. However, Dales suggests their systems will likely consist of a hard carbon anode and a layered oxide, Prussian white or polyanion cathode.

During Phase II, Peak Energy will begin manufacturing both cells and packs domestically, “That will likely be late 2027, early 2028,” Mossburg said. The company will continue to license cell technology from a third party for its BESS’ during this time.

In 2028, Peak Energy aims to open an engineering site in the Denver or Boulder, Colo., area to design the chemistry and technology of sodium-ion cells. These would be manufactured into storage systems at a gigafactory, likely based in the U.S. Midwest or Southeast region. When fully operational, the facility is expected to produce up to 5GW/h of battery cells per year. Moreover, Peak Energy plans to incorporate improvements into its licensed technology to optimize the cost and performance benefits of its storage systems.

Peak Energy states it’s exploring partnerships with businesses owning intellectual property or exhibiting a deep understanding of sodium-ion battery technology. The feedback that Peak has received indicates that the companies are also profoundly interested in deploying their product domestically by leveraging Peak Energy’s ability to scale manufacturing.scale manufacturing capabilities. This includes businesses based in China, as the country offers less stringent off-take agreements enabling Peak Energy to scale sodium-ion storage without hard evidence of committed customers, which can be a common requirement of European and North American partners.

“You need around a billion dollars for a small-scale GW factory, think less than 10 GW,” Mossburg said. “So, the fastest way to get to market is to build a system with cells available from a third party, and China is the only place building capacity to ship enough cells.”

Peak Energy also understands the value of creating an alternative supply chain down the road. This will help to maintain green grid resiliency if China’s supply chain experiences challenges.

Investors

To date, Peak Energy has received $10 million in equity investments. California-based capital market company Eclipse Ventures provided $5 million in a seed round, followed by Japanese electronics conglomerate TDK Ventures’ $5 million investment. The latter owns Amperex Technology Limited, which produced Contemporary Amperex Technology Co. Limited (CATL), the world’s largest lithium-ion producer. In 2021, CATL announced launching lithium-free, sodium-ion batteries for commercial use. Dales suggests this partnership brings Peak Energy’s strategic global relationships to help enhance its supply chain.

Incentives

Peak Energy is expected to qualify for model production and domestic content credits from the Inflation Reduction Act’s tax provisions to incentivize clean energy security. This should happen once the company starts producing cells and packs in the country.

“We expect to qualify for the domestically produced battery cells at $25 kW/h and another $10 kW/h for domestic module production. On top of that, our customers would receive a 10% tax credit when they deploy projects based on our technology because it’s domestically produced,” Dales said. Potential Peak Energy customers include utility providers, independent power producers and industrial companies.

The company is also in the early stages of a conversation with the Department of Energy’s Loan Program Office, which finances domestic projects that advance the deployment of clean energy infrastructure. “We haven’t yet decided the best category for us to go under. That’ll probably happen a year from now,” Dales said.

Peak Energy states that its gigafactory and engineering site will generate over 1,000 full-time jobs once running. The location for the Denver, Boulder, Colo., engineering facility was selected due to its proximity to talent and big solar markets (Texas and California). Peak Energy’s gigafactory will likely be in the Midwest or Southeast region due to the number of new automotive plants in the area, Dales said.