Honeywell invests in ESS to advance adoption of iron flow battery energy storage

Best Renewable Energy Company in Nigeria > Article > Honeywell invests in ESS to advance adoption of iron flow battery energy storage

- by

- Article

Honeywell invests in ESS to advance adoption of iron flow battery energy storage

Honeywell purchased $27.5 million in ESS common stock and intends to purchase $300 million in ESS product, with $15 million prepaid. The collaboration enables Honeywell to integrate ESS technology into its global offering, and ESS gains license to Honeywell’s flow battery intellectual property.

Honeywell and ESS are collaborating on advancing development of iron flow battery (IFB) energy storage systems based on ESS’ patented IFB design with Honeywell’s advanced materials and energy systems expertise.

The Honeywell Company dates back to 1885 with an invention that was a precursor to today’s thermostat. Fast forward many decades, acquisitions and spinoffs later, and one of the company’s many areas of expertise is in utility-scale battery energy storage systems. In 2021 the company developed flow battery technology intended for pairing with wind and solar resources and partnered with Duke Energy to field test the long-duration energy storage (LDES) product.

ESS, founded in 2011, manufactures iron flow batteries using widely available, Earth-abundant materials. Designed for applications that require up to twelve hours of flexible energy capacity, the batteries are used in utility-scale renewable energy installations, remote solar-plus-storage microgrids, solar load-shifting and peak shaving, as well as other ancillary grid services.

At a recent ceremony at RE+ 2023, the U.S. Department of Commerce awarded ESS an Export Achievement Certificate for expanding global deployment of its American-made, innovative long-duration energy storage technology. In response to domestic and global demand, the company announced that it will boost its manufacturing capacity at its Wilsonville, Oregon facility up to 2 GWh annually.

“The demand for long-duration energy storage represents a compelling market opportunity within the energy transition and the combination of Honeywell and ESS technology can accelerate decarbonization for the commercial, industrial and utility sectors,” said Bryan Glover, chief growth officer, Honeywell Performance Materials and Technology (PMT) group. “Our strategic collaboration with ESS will accelerate Honeywell’s ability to bring comprehensive solutions to our customers while working to advance long-duration energy storage across all industries requiring expansive energy storage.”

The collaboration between Honeywell and ESS enables Honeywell to integrate ESS technology into its global offering, and ESS gains license to Honeywell’s flow battery intellectual property. Additionally, the two plan to work together on continual technology advancement, cost reduction and packaging of IFB systems.

ESS battery systems have a prescribed design life of 25 years, the battery modules, electrolyte, plumbing, and other components may well last for decades longer with proper maintenance. The battery, for example, is expected to experience zero degradation over 20,000 cycles. Read more about its duration here.

Honeywell has invested $27.5 million into ESS common stock; purchasing 16.5 million shares at $1.67 per share. Honeywell also received a warrant to purchase an additional 10.6 million shares for $20 million at $1.89 per share. Honeywell also announced its intention to purchase up to $300 million of ESS products, with $15 million prepaid.

In addition to the investment, ESS receives exclusive license of Honeywell IP related to flow batteries

“Today, we are creating superior technology in the critical long-duration energy storage industry,” said Eric Dresselhuys, CEO of ESS. “Combining ESS’ innovative technology and deployment experience with Honeywell’s storage and control system expertise will enable us to drive the clean energy transition and deliver value to our customers, shareholders and communities.”

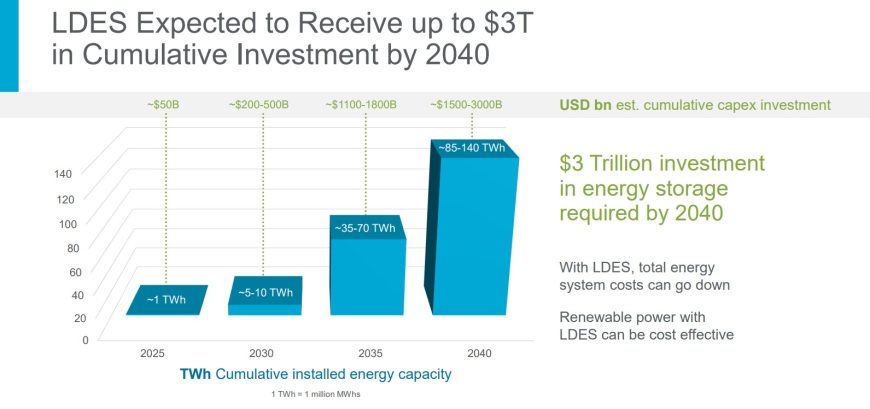

Honeywell and ESS are teaming up at a time of huge growth in long-duration energy storage. According to the Department of Energy’s ‘Pathways to Commercial Liftoff: Long Duration Energy Storage’ report, the U.S. grid needs 225 to 460 GW of LDES capacity for power market application for a net zero economy by 2060. The global LDES market is estimated to be $50 billion per year and forecast to grow significantly with a cumulative investment of up to $3 trillion by 2040, according to the LDES Council and McKinsey & Co.

As the shift to renewable energy accelerates, challenges associated with the intermittency of renewables are becoming more apparent. The solution is to embrace safe and sustainable long-duration energy storage technologies, which can address the intermittency of renewables by ensuring stored energy is available to balance fluctuations in electricity demand and supply.

“Long-duration energy storage is critical to meet local, regional and global net-zero decarbonization goals,” Julia Souder, chief executive officer of the Long Duration Energy Storage Council, told pv magazine USA. “LDES complements rapid renewable growth by offering flexibility, reliability, affordability and security. This partnership allows us to work together to accelerate the various markets and contracts even faster to deploy diverse LDES technologies.”

ESS held a webcast conference call on Monday, September 25, 2023 to discuss the partnership with Honeywell and it will be available on ESS’ Investor Relations website.