European warehouses store 40 GW of unsold solar panels

Best Renewable Energy Company in Nigeria > Article > European warehouses store 40 GW of unsold solar panels

- by

- Article

European warehouses store 40 GW of unsold solar panels

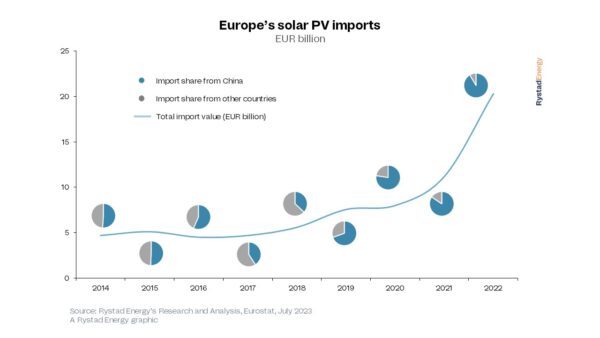

Rystad Energy says that about $7.8 billion of solar panels are now being stored in Europe, but European developers continued to buy solar modules from China throughout the first half of this year.

Rystad Energy has revealed that European warehouses currently host around 40 GW of Chinese-made solar panels.

The Norwegian consulting firm said that the stored solar panels are worth about €7 billion. It noted that solar module imports from China continued to increase this year, despite the high inventory levels.

“Imports in January were 17% higher compared to 2022, with February up 22%, March surging 51%, April up 16%, and May growing 6% over last year,” Rystad Energy explained. “If current import levels continue, 2023 will be a record-breaking year for imports and inventory. Annual imports look set to hit 120 GWdc, far surpassing expected capacity installations of 63 GW (DC).”

Image: Rystad Energy

Rystad Energy said that Europe is “desperate” to secure PV components at affordable prices. It warned that made-in-Europe products may not be immediately available.

“Although efforts are underway to build a reliable solar supply chain in Europe, the need for panels now means leaders cannot wait until 2025 or later to buy European,” said Marius Mordal Bakke, senior supply chain analyst at Rystad Energy.

U.S. supply

The United States is faced with a similar crunch for solar panels as it pursues its own domestic manufacturing goals for the solar supply chain. The nation has excluded several major Chinese solar suppliers from entering the U.S. market under enforcement of the Uyghur Forced Labor Prevention Act (UFLPA).

Clean Energy Associates (CEA) shared that while module assembly has a strong presence today in the U.S., ingot, wafer, and cell production plans have not kept pace, and no plans for greenfield polysilicon plants have materialized.

CEA forecasts the U.S. to reach 17 GW of polysilicon production, 3 GW ingots, 3 GW wafers, 18 GW cell manufacturing, and 40 GW module manufacturing capacities by 2027, suggesting that the U.S. will continue to rely on energy imports for years to come. However, the recent UFLPA enforcement developments may pose a serious challenge to finding suppliers.