FG outlines solution to forex crisis

Best Renewable Energy Company in Nigeria > Article > FG outlines solution to forex crisis

- by

- Article

FG outlines solution to forex crisis

Amid the foreign exchange crisis, which led to the depreciation of naira against dollar, the Federal Government has announced plans to automate international exchange transactions to close wide arbitrage and punish naira speculators.

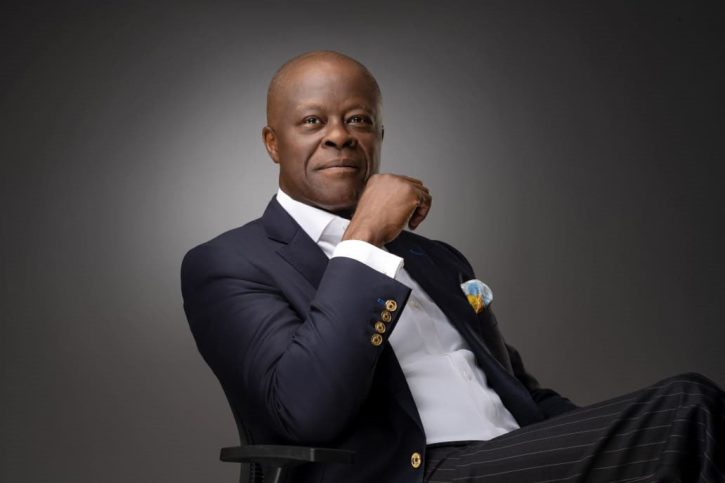

Wale Edun, Minister of Finance and Coordinating Minister of the Economy, disclosed this at Monday’s first-panel session of the 29th Nigeria Economic Summit, #NES29, in Abuja.

According to him, all dealings in the foreign exchange market, from the official to the parallel market where huge arbitrage has consistently occurred, would be thoroughly monitored, and offenders would be fished out and punished.

He also disclosed that President Bola Ahmed Tinubu signed two executive orders last week.

The minister said a plan to revamp the foreign exchange market would unfold.

He admitted that Nigeria’s foreign exchange market was not functioning effectively due to illiquidity, saying the government was prepared to do everything required to change the status quo.

“One of them is an executive order that allows forbearance for all the cash in the economy to come in and formally boost the money supply legally.

“There’s another executive order that allows domestic issuance of foreign currency issues so that it will allow incentives to provide that foreign exchange for whatever source.

“Foreign exchange market will be simplified and reformed such that all legal and legitimate transactions will fall within the purview of the authorities and in the formal foreign exchange market. Anything outside that will be illegal, a criminal offence, and punishable,” Edun said.

DAILY POST reports that the naira was exchanged at N1,160/$1 at the parallel market on Monday morning.

Meanwhile, at the FMDQ market on Friday, the naira closed at $/N808.27.